I was recently conducting a workshop on Lean Canvas, full of bright-eyed entrepreneurs sketching out their brilliant business ideas.

But when the conversation shifted to how they’d actually make money, their monetization model, the energy dipped. Eyes glazed over, jargon flew around, and suddenly, things felt… complicated. “Subscription? Freemium? Affiliate what-now?” The confusion was palpable.

It struck me then: we talk a lot about what businesses do, but often stumble on the crucial part.

How they generate revenue sustainably. If you’ve ever felt that same fog descend when thinking about revenue streams, you’re not alone!

That workshop moment inspired me to clear the air. This article is your friendly guide, using well-known brands to demystify the various ways businesses, both old-school traditional and cutting-edge digital, turn their value into cash. We’ll break down the most common monetization strategies with simple explanations and relatable examples, showing you who can benefit from each.

Think of monetization simply as your business’s plan for making money. It’s how you capture value back from the value you provide. Ready to see how brands like Netflix, Apple, and Amazon make it work? Let’s go!

Category 1: Selling Stuff Directly (The Straight Shooters)

This is the most classic way businesses make money – exchanging a product or service for a one-off payment.

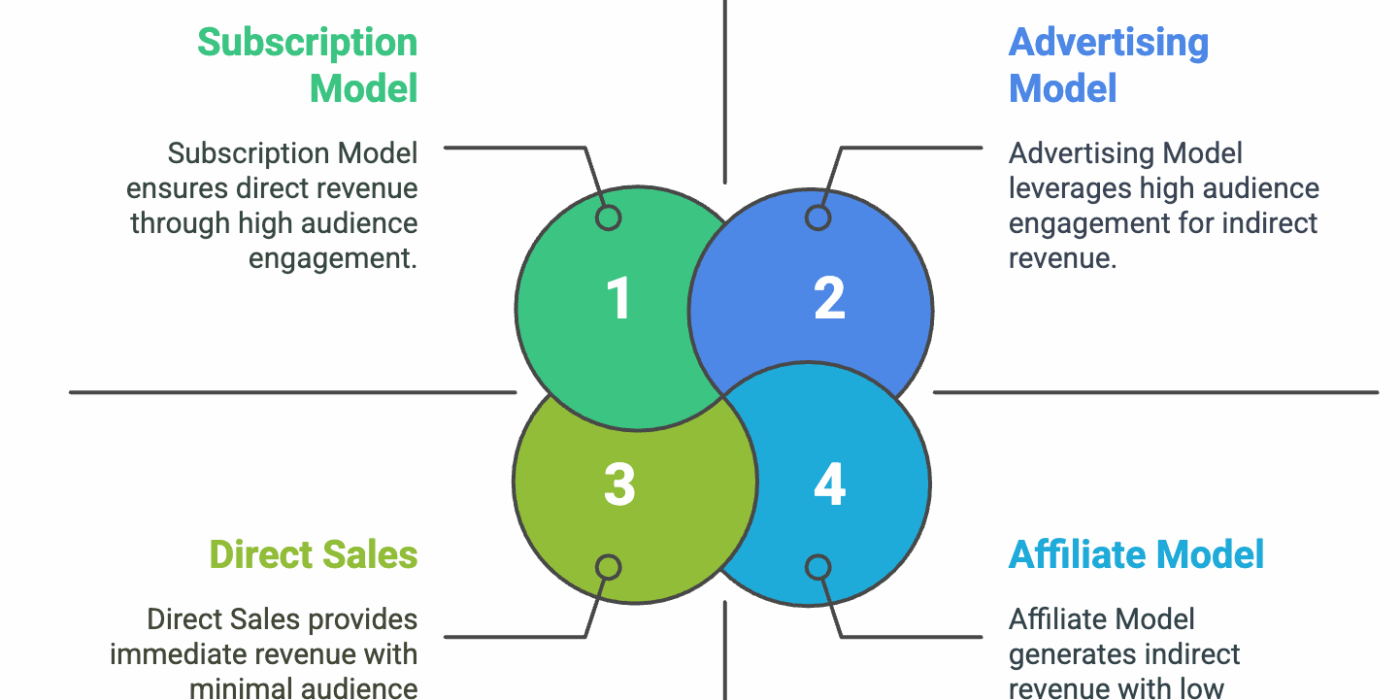

Direct Sales (Asset Sale)

Selling a physical item (like shoes, furniture, a gadget) or a digital item (like an e-book, a photo, a software licence) that the customer then owns.

You walk into an Apple Store, pay for an iPhone, and walk out with it. Or you buy a digital copy of a game from the Nintendo eShop.

For example: When Apple sells an iPhone, a MacBook, or AirPods directly to a customer through their stores or website, that’s a direct asset sale. The customer pays once and owns the physical product.

Who can use it? Retailers (Target, Walmart), manufacturers selling directly (Tesla), e-commerce stores (Amazon selling its own inventory), software companies selling perpetual licenses, authors selling e-books directly. (Both Traditional & Digital)

Service Fees

Charging for your time, expertise, or the completion of a specific task. This can be hourly, per project, or a retainer for ongoing work.

Hiring Geek Squad (from Best Buy) to install your home theater for a fixed fee, or paying a law firm based on their billable hours.

For example: Consulting firms like Accenture or Deloitte charge clients large fees for specific projects, like implementing a new software system or developing a business strategy. Your local hair salon charges a fee for the service of cutting your hair.

Who can use it? Consultants, agencies (Ogilvy – marketing), professional services firms (law, accounting), repair services (Midas), freelancers, coaches. (Both Traditional & Digital)

Pay-Per-View / Transactional Video on Demand (TVOD)

Charging a one-time fee to watch a specific piece of video content, like a new movie rental online or a live sporting event.

Renting a movie on Amazon Prime Video or the Apple TV app (iTunes Store) even if you don’t subscribe to their main service, or buying access to a specific UFC fight night.

For example: If you want to watch the latest blockbuster movie at home shortly after its cinema release, you might rent it for ~$19.99 directly from a platform like Apple TV or Google Play Movies. You pay once for temporary access to that specific film.

Who can use it? Movie studios, streaming platforms offering rentals/purchases (Vudu, Rakuten TV), live event broadcasters (sports leagues, concert promoters). (Digital Primarily)

Category 2: Charging for Access & Usage (The Gatekeepers & Meter Readers)

These models involve ongoing payments for access or charging based on how much something is used.

Subscription / Membership Model

Customers pay a regular fee (e.g., monthly, yearly) for ongoing access to a product, service, content, or community perks.

Netflix, Spotify Premium, Amazon Prime, Adobe Creative Cloud.

For example: Netflix charges a monthly fee for unlimited access to its library of movies and TV shows. Microsoft 365 (formerly Office 365) charges a recurring fee for access to Word, Excel, PowerPoint, and cloud storage.

Who can use it? SaaS companies (Salesforce, Slack), streaming services, content websites (The Wall Street Journal), membership communities, subscription boxes (Blue Apron), gyms (Fitness First). (Both Traditional & Digital)

Usage-Based / Pay-Per-Use Model

Charging customers based on how much they consume or use a service. More usage = higher bill.

Think of it like this: Cloud computing services like Amazon Web Services (AWS) or Microsoft Azure, where you pay based on the amount of data stored, compute power used, etc.

For example: Twilio, a communication platform, charges developers based on the number of SMS messages sent or phone call minutes used via their API. Cloud storage providers often charge per gigabyte stored beyond a certain threshold.

Who can use it? Utility companies, cloud service providers (IaaS, PaaS), API providers, telecommunication companies, some SaaS platforms tracking specific metrics. (Both Traditional & Digital)

Freemium Model

Offering a basic version of your product/service for free forever, hoping a percentage of users will upgrade to a paid, premium version with more features, fewer restrictions, or no ads.

Spotify (free with ads vs. Premium), Dropbox (free basic storage vs. paid plans), LinkedIn (free networking vs. Premium features), Zoom (free meetings with limits vs. paid plans).

For example: Evernote, the note-taking app, offers a free basic plan with limitations on uploads and device syncing. Users who need more storage, offline access, and advanced features can upgrade to paid Personal or Professional plans.

Who can use it? SaaS companies, mobile apps (Duolingo – free lessons, paid Super Duolingo), online tools, gaming companies, some content platforms. (Digital Primarily)

Category 3: Making Money from Your Audience (The Attention Merchants)

These models generate revenue because you have an audience, even if the audience members themselves don’t pay directly (or pay less).

Advertising Model

Selling space or time to advertisers who want to reach your audience. You get paid for showing their ads.

Ads shown by Google in search results, ads within your Facebook or Instagram feed, commercials during the Super Bowl on TV, ads on YouTube videos.

For example: Meta (Facebook & Instagram) makes the vast majority of its revenue by showing targeted ads to its billions of users. Google does the same with search results and YouTube videos. Websites like BuzzFeed display ads alongside their content.

Who can use it? Search engines, social media platforms, websites/blogs with high traffic, mobile apps, traditional media (TV, radio, newspapers), podcasts, newsletters. (Both Traditional & Digital)

Affiliate / Referral Model

Earning a commission by promoting another company’s product or service. You include a special link, and if someone clicks it and makes a purchase, you get a cut.

A tech review site linking to products on Amazon using an affiliate link. A travel blogger recommending a hotel via a Booking.com affiliate link.

For example: Wirecutter (owned by The New York Times) rigorously tests and reviews products, then includes links (often affiliate links) to retailers like Amazon or Best Buy where readers can purchase the recommended items.

Wirecutter earns a commission if a purchase is made through their link.

Who can use it? Bloggers, influencers, content creators, comparison websites (Check24 in Germany), review sites, email marketers. (Both Traditional sales agents & Digital)

Data Monetization (via Advertising)

While direct selling of raw user data is highly regulated and often frowned upon, platforms use aggregated and anonymized user data and behavior insights to offer highly effective targeted advertising. This is an indirect form of data monetization.

Facebook knows (based on your activity, likes, demographics – aggregated and anonymized for ad targeting) that you might be interested in hiking gear, so it shows you ads from outdoor brands.

For example: Meta (Facebook/Instagram) and Google leverage the vast amounts of data they have about user interests and behavior (kept anonymous at the individual level for the advertiser) to allow advertisers to target specific demographics and interest groups with incredible precision, making their ad platforms highly valuable.

Who can use it? Large platforms with significant user interaction data (social media, search engines, large e-commerce sites), always prioritizing user privacy and adhering to regulations like GDPR. (Digital Primarily)

Category 4: Leveraging Your Assets & Brand (The Licensors & Franchisors)

Here, you make money by letting others use things you own. Your brand, your inventions, your property.

Licensing Model

Granting someone permission to use your intellectual property (like a patent, trademark, software code, copyrighted character, or content) in exchange for fees or royalties.

Disney licensing Star Wars or Marvel characters to LEGO for themed sets. Microsoft licensing Windows 10/11 to PC makers like Dell and HP.

For example: Pharmaceutical company Pfizer licenses patents for drugs it developed to other companies for manufacturing or distribution in certain regions. Dolby licenses its audio processing technologies (like Dolby Atmos) to makers of TVs, soundbars, and smartphones.

Who can use it? Software companies, patent holders, brand owners (Coca-Cola licensing its logo for merchandise), artists/musicians (licensing songs for movies), content creators (syndicating articles). (Both Traditional & Digital)

Franchising Model

Selling the right to use your established business name, model, and operating system to independent owners (franchisees) who open their own locations. You receive initial franchise fees and ongoing royalties.

McDonald’s, Subway, KFC, 7-Eleven, The UPS Store, Marriott hotels.

For example: When you visit a McDonald’s, it’s likely owned and operated by a local franchisee who has paid McDonald’s corporation for the right to use its brand, menu, ingredients, and operating system, and continues to pay royalties on sales.

Who can use it? Successful restaurants, retail stores, service businesses (hotels, gyms, cleaning services) with a proven, replicable system. (Primarily Traditional, Digitally Supported)

Leasing / Renting Model

Allowing someone to temporarily use a physical asset you own (like a building, car, or equipment) in exchange for regular payments.

Renting a car from Hertz or Sixt. Leasing office space from a commercial real estate company.

For example: Car rental companies like Avis or Enterprise make money by renting out their fleet of vehicles for short periods. Companies that own large commercial aeroplanes often lease them to airlines like Lufthansa or Delta.

Who can use it? Real estate owners (commercial, residential), equipment rental companies (United Rentals), car rental/leasing agencies. (Primarily Traditional)

Category 5: Playing Matchmaker (The Intermediaries)

These businesses make money by connecting different groups and facilitating transactions between them.

Intermediation / Marketplace Model

Creating a platform where buyers and sellers (or providers and consumers) can find each other and conduct business. The platform typically charges a commission on transactions or listing fees.

eBay, Amazon Marketplace, Airbnb, Uber, Etsy, Apple’s App Store, Upwork.

For example: Airbnb doesn’t own the properties listed; it acts as a platform connecting hosts (people renting out space) with guests. Airbnb takes a service fee from both the host and the guest for each booking facilitated through its platform. Apple App Store takes a commission (typically 15-30%) on paid app sales and in-app purchases made through its platform.

Who can use it? E-commerce platforms connecting third-party sellers, job boards (LinkedIn Jobs), freelance platforms, app stores, ride-sharing services, rental platforms, stock exchanges (NYSE). (Both Traditional brokers & Digital platforms)

Category 6: The Extras & Clever Combos (Add-ons & Hybrids)

These models focus on supplementary income or specific product/pricing strategies.

Ancillary Revenue / Value-Added Services

Selling extra products or services that complement your main offering.

Budget airlines like Ryanair or EasyJet charging extra for checked baggage, priority boarding, and seat selection. Apple selling AppleCare+ extended warranty with its devices.

For example: When you buy electronics from Best Buy, they might offer Geek Squad services for setup, installation, or tech support for an additional fee. This is ancillary revenue beyond the initial product sale.

Who can use it? Airlines, hotels, electronics retailers, software companies (selling premium support), car dealerships (offering financing, extended warranties). (Both Traditional & Digital)

In-App Purchases / Microtransactions

Selling small digital items, features, currency, or conveniences directly within a mobile app or game.

Buying PokéCoins in Pokémon GO, V-Bucks in Fortnite for cosmetic items, extra lives or boosters in Candy Crush Saga.

For example: Many popular mobile games like Clash of Clans or Roblox are free to download and play but offer numerous opportunities to spend real money on virtual currency or items to speed up progress, customize avatars, or gain advantages.

Who can use it? Mobile game developers, app developers offering feature unlocks, virtual goods, or ad removal (Tinder offering Super Likes or Rewinds). (Digital)

Razor and Blades Model

Selling a core “base” product cheaply (the razor) to lock customers in, then making profits on repeated sales of high-margin consumables or refills (the blades).

Gillette selling affordable razor handles but profiting more from ongoing sales of replacement blade cartridges. HP, Canon, and Epson selling inexpensive printers but making significant margins on ink cartridges.

Keurig sells its coffee brewing machines relatively cheaply, but its primary profit comes from the recurring purchase of proprietary K-Cup coffee pods that only work with its machines. Nespresso uses a similar model.

Who can use it? Companies selling hardware with required consumables (printers, coffee makers, water filters, actual razors!). (Primarily Traditional, can be adapted)

Open Source Model (Indirect Monetization)

Offering the core software code for free (open source), allowing anyone to use, modify, and distribute it. Money is made around the free product via paid support, services, hosting, or premium versions.

Android OS is open source, but Google makes money via the Play Store, ads, and services built on top. WordPress.org software is free, but companies like WP Engine offer premium hosting and support.

Red Hat builds enterprise products (like Red Hat Enterprise Linux) based on free, open-source projects (like Fedora). They make money by selling subscriptions that include long-term support, security patches, management tools, and certifications for businesses using their enterprise version.

Who can use it? Software companies building developer tools (Docker), infrastructure software (Canonical for Ubuntu), databases (MongoDB), content management systems (Automattic for WordPress.com services). (Digital)

Category 7: Relying on Support (Community & Contributions)

Revenue comes from voluntary payments or fees for community belonging.

Donations / Crowdfunding / Patronage

Receiving voluntary contributions from individuals or organizations who support your cause, project, or content.

Wikipedia asking for donations to keep running. A musician using Patreon to get recurring support from fans. A tech gadget getting initial funding via Kickstarter.

The Mozilla Foundation, which develops the free Firefox web browser, is funded through a combination of search engine royalties (like from Google), grants, and donations from individuals and corporations who support its mission for an open internet. Many YouTube creators use Patreon to offer exclusive content to paying supporters.

Who can use it? Non-profits (Red Cross), charities, open-source projects (Signal messenger), content creators, individuals funding specific projects (often via dedicated platforms). (Both Traditional & Digital)

Finding Your Fit: It’s Often a Mix!

See? Even the biggest names often use a blend of these strategies! Amazon is a prime example: Direct Sales (selling its own products), Marketplace Fees (from third-party sellers), Subscriptions (Amazon Prime), Advertising (on its site), Usage-Based (AWS cloud services), and more!

The key is to choose the monetization model(s) that best fit:

Your product/service: What value are you providing? Is it ongoing or one-time?

Your target audience: Who are your customers? What are they willing to pay for and how? (Think about Apple’s premium pricing vs. Xiaomi’s value focus).

Your business goals: Are you aiming for rapid user growth (Facebook initially) or immediate profitability?

Your market: What are competitors like Coke and Pepsi doing?

Hopefully, seeing these familiar brands mapped to different monetization models makes the whole concept much clearer and less intimidating. It’s not about finding one “magic bullet,” but understanding the diverse toolkit available to build a sustainable and profitable business, just like the companies you interact with every day.

Now, which combination of these models feels right for your big idea?